The condo market is in the doldrums. But is that true just in Florida?

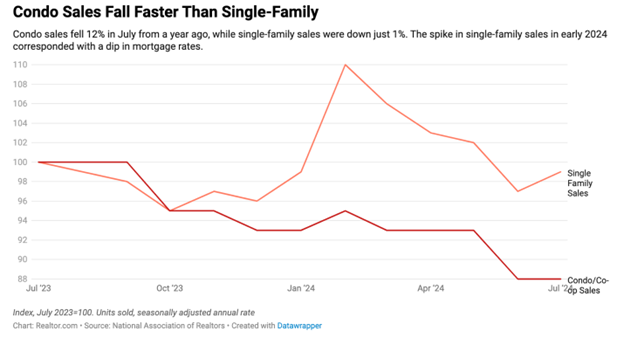

This might come as a surprise to homebuyers who know that condominiums are often a cheaper alternative to single-family houses. But in July, condo sales were down 12% nationwide from a year ago, compared with a slump of just 1% for single-family homes, according to data from the National Association of Realtors®. Naples on the other hand stands a bit apart from the rest of Florida. Naples had an increase of 6.9% in condo sales in July year over year while single-family home sales had a decrease of 10.1%.

The divergence isn’t limited to Florida, where condos abound but soaring insurance premiums and a new law that has jacked up assessment fees are weighing heavily on the market.

In the 12 months through July, condo sales were down 17% in the Midwest, 15% in the South, and 11% in the West. Sales in the Northeast were flat on the year. “The condominium market appears to be softer than single-family, and it doesn’t appear to be specifically related to the Florida market,” said NAR Chief Economist Lawrence Yun. Yun noted that there were inconsistent trends even within Florida, with condo sales up in Fort Myers, but down in Daytona Beach. “So there’s nothing consistent in the Florida-specific condition,” he said.

Nationally, the share of active listings composed of condos has climbed annually each month since May 2023, according to Realtor.com® listing data. In July, 21.2% of active listings were condos, compared with 19.5% one year earlier and 17.0% in July 2019. “Condo inventory reached its highest level in four years in July as supply outpaced demand,” says Realtor.com senior economic research analyst Hannah Jones.

Buyers seeking ‘more bang for their buck’

With home prices near record highs, condos might seem like a more affordable option with a lower barrier to entry. In July, the median list price for condos nationwide was $392,500, compared with $449,900 for single-family homes, according to Realtor.com listing data. In July, the median list price for condos in Naples was $470,000 compared with $717,500 for single-family homes. But Jones notes that because condos are more likely to be located in high-priced urban areas, condo pricing per square foot is consistently higher than that of single-family homes. Although the price-per-square-foot premium for condos has fallen from its recent peak of nearly 60% in early 2021, it still stood at 35.8% in July. That month, the median list price for condos was $296 per square foot versus $218 for single-family homes.

“Still-high mortgage rates and home prices seem to have taken a bigger toll on the condo market than the single-family market as buyers look for more bang for their buck,” says Jones. “As a result, the condo market pace is slowing on an annual basis, and condos are spending more time on market than single-family homes.“ For sellers, the slowing market has presented headaches. Nationally Condos now spend eight more days on the market, on average, than single-family homes. The median time on the market for condos in July was 58 days, compared with 50 days one year prior. Although the single-family market has also slowed over the past year, it slowed only six days from a year ago, to 50 days in July. In Naples, Florida during July condos spent an average of 88 days on the market compared to 50 days one year ago. The single-family homes in Naples spend 73 days as opposed to 61 days in July 2023.

Condo prices have also fallen annually each month since November 2023. Although the median list price for condos in July was still 30.9% higher than pre-pandemic, condo list prices were down 5.4% from a year earlier, compared with a 0.2% gain for single-family homes. It means that condos might be growing less appealing to buyers seeking a return from rising home values, in comparison with single-family homes.

Rising HOA fees discourage potential condo buyers

Nationwide, the average monthly homeowners association fee for condos currently listed on Realtor.com is $650. “Property values have risen substantially over the last five years, as have the association fees,” says Patrick Wraight, director at the Insurance Journal’s Academy of Insurance. “Then there are the potential of association assessments because buildings age, and with age comes maintenance, upkeep, and upgrades.” In a recent article, Wraight described how condominium buildings are growing harder to insure, with more restrictive terms, higher premiums, and stringent underwriting requirements.

The condominium building boom in the late 1970s and early 1980s means that many existing buildings have passed the 40-year mark and might need extensive deferred maintenance.

In 2021, the Champlain Towers South building in Surfside, FL, which was built in 1981, partly collapsed due to deferred maintenance issues. Ninety-eight people died, highlighting the tragic risks of allowing identified maintenance issues to go unfixed.

In 2021, the Champlain Towers South building in Surfside, FL, which was built in 1981, partly collapsed due to deferred maintenance issues, killing 98.

(Getty)

Florida responded with a new law that raised reserve fund requirements for condos, resulting in many special assessments and rising fees. But maintenance issues are also raising costs for condo owners outside the Sunshine State. Across the country, many property insurers have paid out more in claims than they collected in premiums in recent years, due in part to climate-related disasters.

As a result, writes Wraight, “insurance companies have started to protect themselves by writing fewer risks, charging more for the risks that they are writing, and restricting coverage through policy changes.” Rising maintenance costs and insurance fees have driven up HOA fees, which cover property insurance for the building’s common areas and the association’s liability. It all translates into higher monthly costs for condo owners.